How you can travel much more often thanks free airline tickets. We have gathered in one place all the useful information, how can you get a free ticketto save a lot of money already in one of the next trips. It will be about bonus airline miles and how to save them much faster than 95% of travelers and use them even if you fly very rarely or don’t fly at all.

From this article you will learn:

- How to fly for free at least once a year

- What are airline miles and how to use them

- How to get free tickets, even if you fly very rarely or don’t fly at all

How to fly for free at least once a year

If you often use the plane, then it will be easier for you, although a little lower we will tell you a way for those who fly extremely rarely.

At the next flight, simply register in the airline's bonus program. Then everything is simple: every time you buy a ticket, you will receive bonus miles to your account, which, ultimately, can be exchanged for a free ticket.

In addition to flights with flights of the airline and its partners, you can also earn miles in other ways. For example, making purchases on the websites of airline partners - in stores, hotels, car rentals, etc.

The purchases themselves do not rise in price. It’s just that every time your account will be replenished with new bonus miles, approximating a free trip.

Another question is that few people fly all the time on the same airline. How to be in this case? Not to register in each bonus program? About it below.

Important notice! Only a plane ticket will be free. Fuel and service charges will have to be paid extra. More is written about this on the websites of airlines.

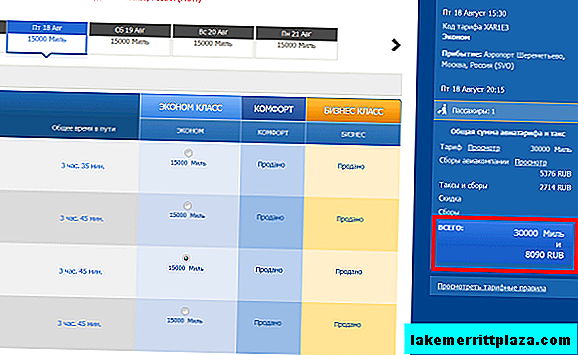

The Aeroflot flight from Moscow to Rome from August 3 to 18, 2017 will cost 30,000 bonus miles and 8090 rubles. fees and taxes. A program participant will save 12,800 rubles on tickets.

How to choose a bonus program

The choice of program depends largely on the direction of flight. For example, you often fly to Italy. In Italy, the largest air carrier is Alitalia. Also, Aeroflot, Air France and other airlines make flights here. Most of them are members of the SkyTeam passenger airline alliance. Therefore, to accumulate miles and fly for free in this direction, we are looking for a SkyTeam alliance program, for example, the Aeroflot bonus.

There are only 3 passenger air alliances!

- Star Alliance (Miles & More bonus program. Register here)

- SkyTeam (Aeroflot Bonus program. Register here)

- Oneworld (S7 PRIORITY program. Registration here)

Registration in the airline bonus program allows you to earn miles, making flights with all members of the alliance, as well as when ordering additional services on partner sites.

Now the question is how to accumulate miles if you fly rarely or don’t fly at all. There is a solution too ...

SkyTeam Alliance Aircraft

How to get free tickets if you rarely fly

Those who fly less frequently can join one or several banking programs for accumulating miles. Many Russian (and not only Russian) banks offer such an interesting feature to their regular customers.

So to participate in the program Miles & More You can open Citibank or Russian Standard bank cards. Saving for a free flight ticket under the S7 Priority program allows the corresponding cards of Alfa Bank, Promsvyazbank, Bank of Moscow and UniCredit Bank. You can earn miles under the Aeroflot-bonus program with bank cards of Sberbank, Alfa Bank, Citibank and SMP Bank.

On a note! You can open several cards of the same program in different banks and save bonuses faster.

Miles cards of the Russian Standard Bank

Each bank offers its customers special conditions for earning miles, the details of which can be found on the corresponding website of the bank. However, there are common points:

- For issuing a card, any bank will give a certain number of miles, as a rule, from 500 to 7000.

- Miles are awarded for purchases and payments made on the card at the rate of 1 mile for 50-60 rubles.

- For purchases from bank partners, the number of miles earned can increase several times.

Which bank card to choose is up to you. Blogoitaliano will only compare offers from different banks.

Important! If you have already been connected to the program for accumulating miles at one of the airlines, do not forget to inform the bank employees about this when applying for a card.

Miles & More Program (Star Alliance)

| Card name | Miles & More Citibank | Miles & More Bank "Russian Standard" |

| Card type | Credit | Credit or Debit |

| Welcome miles | Classic - 3000 m. Premium - 5000 m. | Classic - 3000 m. (Credit), 1500 m. (Debit) Gold - 5000 m. (Credit), 2500 m. (Debit) Signature - 7000 m, (credit) 3500 m. (Debit) |

| Cost 1 mile | 45 p. | 50 p. (credit), 60 p. (debit) |

| The cost of annual card maintenance (primary / secondary) | Classic - 950 p. / 450 p. Platinum - 2950 p. / 950 p. | Classic - 900 p. / 450 p. Gold - 3000 p. / 1500 p. Signature - 10000 p. / 5000 p. |

| Additional services | Bonuses from partner stores of the Miles & More program. Travel insurance and discounts up to 30% in stores, hotels and restaurants in Russia and the world. | Bonuses from partner stores of the Miles & More program. Travel insurance, visa insurance, purchase insurance, 10% discount on hotel reservations, concierge services. |

| Miles Expiration Date | Is not limited | Award Miles - Unlimited Status Miles - 1 year |

| Details | Citibank Program | The program of the bank “Russian Standard” |

Aeroflot Bonus Program (SkyTeam Alliance)

| Card name | Aeroflot-Citibank | Aeroflot Sberbank | Aeroflot Alfa Bank |

| Card type | Credit | Credit | Credit or Debit |

| Welcome miles | Classic - 1000 m. Premium - 2000 m. | Classic - 500 m. Gold - 1000 m. Signature - 1000 m. | Standart - 500 m. Gold - 1000 m. Platinum - 1000 m. World Black Edition 1000 m. |

| Cost 1 mile | 60 p. | Classic - 60 p. Gold - 40 p. Signature - 30 p. | Standart - 54 p. Gold - 40 p. Platinum - 34 p. World Black Edition - 30 p. |

| The cost of annual servicing of the card (basic / additional) | Classic - 950 p. / 450 p. Premium - 2950 p. / 950 p. | Classic - 900 r. Gold - 3500 p. Signature - 12000 p. | Standart - from 900 r. Gold - from 2500 r. Platinum - 7990 p. World Black Edition - 11,990 p. |

| Additional services | Bonuses from Aeroflot bonus program partner stores. Travel insurance. | Travel insurance, special offers and discounts | Bonuses from Aeroflot bonus program partner stores. Travel insurance. |

| Miles Expiration Date | Miles are canceled if in 2 years no flights have been made at the tariffs involved in accruing bonuses | ||

| Details | Aeroflot bonus from Citibank | Aeroflot-bonus of Sberbank of Russia | Aeroflot Bonus Alfa Bank |

S7 Priority Program (OneWorld Alliance)

| Card name | "S7 Priority" Alfa Bank | "S7 Priority" Promsvyazbank |

| Card type | Credit or Debit | Since June 15, 2017 the issue of cards has been discontinued |

| Welcome miles | Green - 500 m. Gold - 1000 m. Platinum - 1000 m. Black Edition - 1000 m. | 1000 m. |

| Cost 1 mile | Green - 60 p. Gold - 48 p. Platinum - 40 p. Black Edition - 40 p. | 48 p. |

| The cost of annual card maintenance (primary / secondary) | Green - 349 p. Gold - 699 p. Platinum - 999 p. Black Edition - 1850 p. | 990 p. |

| Additional services | Bonuses and discounts in partner stores. | First flight with S7 will bring 1000 bonus miles |

| Miles Expiration Date | Miles are canceled if no flights have been completed in 2 years at the rates involved in accruing miles | |

| Details | S7 program from Alfa Bank | Promsvyazbank S7 Program |

How to save and spend miles

Regardless of the choice of card and bank, you can always speed up the process of accumulating miles. For this:

- Earn bonus miles when you open your main card.

- Open additional cards for your friends and relatives you trust.

- You can open several cards of the same program in different banks.

- Shop for goods and services with a card, not cash.

- To get double bonuses, make purchases in the partner stores of the bank.

- Fly more often with selected airlines.

- Keep track of promotions and airline deals.

Aeroflot bonuses can be used to pay for flights to any of the 20 airlines of the SkyTeam alliance

Spending miles is easy. To do this, just go to the website of the airline, for example, Aeroflot. Enter your personal account, find the form for buying tickets, select the flight you are interested in and be sure to check the "Pay by miles" box. That's all!

Is it possible to accumulate miles of all airlines with one card

Many banks, for example, Alfa Bank, VTB24, Vanguard, Binbank, etc. offer cards that allow you to buy tickets not only of a certain alliance. So with bonus miles Alfa-Miles cards from Alfa Bank you can pay for the services of 380 partner airlines of the bank right away, and VTB24 World Map with the services of 800 airlines. In addition to airline tickets, bonuses can also be spent on train tickets, hotels, insurance or transfer. True, you will have to do this on a special site.

VTB24 offers good conditions for accumulating miles for World Map Platinum. The only big minus of the card is that the annual service will cost 10,200 rubles / year with a card turnover of less than 65 thousand rubles / month. If you pay for purchases worth more than 65 thousand rubles a month, and also often travel abroad, we advise you to pay attention to this proposal. Detailed conditions can be found here.

You will receive a free Moscow-Rome ticket on the Platinum World Map after 6 months with a monthly cost of 30,000 rubles.

But perhaps The best loyalty program to date is offered by Tinkoff Bank with an All Airlines card..

The cost of a mile on an All Airlines card is 50 rubles. when paying in stores and 100 rubles. when paying for online purchases. Additional points can be obtained:

- for card activation (up to 5000 m.)

- for the purchase of any air and train tickets on the website www.travel.tinkoff.ru (5 miles for every 100 rubles)

- for the purchase of tickets on any sites (3 m. for every 100 rubles.)

- for hotel reservation and car rental on the website www.travel.tinkoff.ru (10 meters for every 100 rubles)

- for purchases on special offers of the bank up to 30 m. for every 100 rubles.

In monetary terms, 1 mile = 1 ruble, which simplifies the calculation of bonus miles when buying a free plane ticket.

Another indisputable advantage of the All Airlines card is that you can use your miles to pay for any airline tickets (even low-cost airlines) bought anywhere, whether it’s an airline’s website, an online airline reservation system or a ticket office at the airport. At the same time, you can pay with miles not only the ticket itself, but also the fees and charges included in the cost of the flight. An additional “bun” will be medical insurance for those traveling abroad in the amount of $ 50,000.

All Airlines Tinkoff Bank Card - The Best Card for Earning Miles

The Tinkoff Bank system of payment with bonus points is not quite familiar. You must buy any ticket with an All Airlines card for your money, and then in your account on the website request a refund from the bank. The bank is converting: accumulated miles are deducted from your account and spent rubles are returned.

You can request the transfer of bonuses to cash equivalents within 90 days from the date of ticket issuance. So, if you don’t have enough for a free ticket, there are still almost 3 months to get the necessary amount.

For more information on how to use the map to fly for free, see the short video below. By the way, the author of the video also has a gorgeous course. How to buy tickets 2 times cheaper. The Course has a lot of useful and not only for beginners.

| Get an All Airlines Card ››› |

By the way, the card itself is credit, and interest will be charged for using the funds. However, the card has interest-free period up to 55 days. This means that if during this period after making a purchase you replenish the card, then interest for using a loan does not accrue.

By cons Maps include:

- for any card transactions abroad, a commission of 3% is taken;

- annual card maintenance will cost 1890 rubles (but where is it free? :);

- the minimum ticket price when paying with miles must be at least 6,000 rubles;

- missing miles cannot be redeemed, as in some programs of other banks;

- miles are deducted in increments of 3000 m. not in favor of the customer. For example, you purchased a ticket with a total value of 11250 rubles. A refund of this amount will require 12,000 miles. And for a ticket worth 12090 rubles. already 15,000 miles. The second option is not profitable, since 2910 accumulated bonuses are lost. In this case, you can choose a more convenient flight, which is slightly more expensive.

In general, despite a number of minuses, Tinkoff Bank offers one of the best cards for earning miles. The main thing is to monitor the credit limit on time and travel more often, so that it is possible to save bonuses faster. You can fill out an application for a card at this link.

In the end

All information in this article. checked for relevance on 08/21/2017 of the year. Please note that conditions at banks and airlines may change over time. For those who like to travel, we also recommend our article How to buy the cheapest plane ticket.

If this article has been useful to you, be sure to share it on social networksso that your friends can also take advantage of these recommendations.

Photo by Adrian Pingstone